UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

Smith & Wesson Brands, Inc. |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Smith & Wesson® 2021 NOTICE OF ANNUAL SHAREHOLDER MEETING AND PROXY STATEMENT 2022 NOTICE OF ANNUAL STOCKHOLDER MEETING AND PROXY STATEMENT

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date: Tuesday, September 19, 2023 |

| Time: 10a.m. Eastern Time |

| Location: www.virtualshareholder meeting.com/SWBI2023 |

|

|

|

|

|

|

The Annual Meeting of Stockholders of Smith & Wesson Brands, Inc., a Nevada corporation, will be held at 12:10:00 p.m.a.m., Eastern Time, on Monday,Tuesday, September 27, 2021.19, 2023 (the “2023 Annual Meeting”). The 2023 Annual Meeting of Stockholders will be a virtual meeting of stockholders. You will be able to attend the 2023 Annual Meeting, of Stockholders, vote, and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/SWBI2021SWBI2023 and entering the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials.

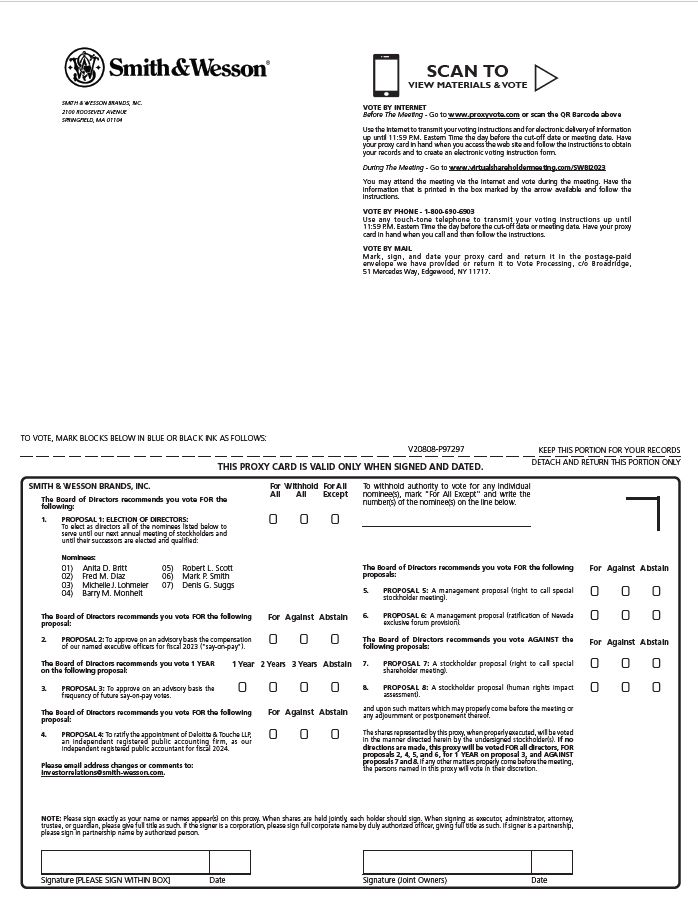

The 2023 Annual Meeting of Stockholders will be held for the following purposes:

|

| |

1 |

| |

2 | Advisory vote to approve executive compensation ("say-on-pay") | |

3 | Advisory vote on the frequency of future say-on-pay votes | |

4 | Ratification of appointment of independent registered public accounting firm | |

5 | Advisory vote to call special stockholder meeting | |

6 | Ratification of Nevada exclusive forum provision | |

7 | Stockholder proposals, if properly presented | |

And such other business as may properly come before the 2023 Annual Meeting or any adjournment or postponement thereof. | ||

Stockholders of record at the close of business on July 28, 2023 may vote at the 2023 Annual Meeting.

These proxy materials were first made available to our stockholders on the internet on August 10, 2023.

Sincerely,

Kevin A. Maxwell

Senior Vice President,

General Counsel, Chief Compliance Officer, and Secretary

August 10, 2023

Table of Contents

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. You should read this entire Proxy Statement carefully before voting.

MEETING INFORMATION | |||||||

Time and Date | 10:00 a.m., Eastern Time, on Tuesday, September 19, 2023 | ||||||

Location | Online via webcast at www.virtualshareholdermeeting.com/SWBI2023 | ||||||

Record Date | July 28, 2023 | ||||||

MEETING AGENDA | |||||||

Proposals | Board Recommendation | Page | |||

|

|

|

| ||

1. | Election of Seven Directors | FOR each nominee | 3 | ||

2. | Advisory Vote to Approve Executive Compensation | FOR | 16 | ||

3. | Advisory Vote on Frequency of Future Say-on-Pay Votes |

| ONE YEAR |

| 17 |

4. | Ratification of Appointment of Deloitte & Touche, LLP | FOR | 44 | ||

5. | Management Proposal - Advisory Vote to Call Special Stockholder Meeting | FOR | 46 | ||

6. | Management Proposal - Ratification of Nevada Exclusive Forum Provision |

| FOR |

| 48 |

7. | Stockholder Proposal - Right to Call Special Shareholder Meeting |

| AGAINST |

| 50 |

8. | Stockholder Proposal - Human Rights Impact Assessment |

| AGAINST |

| 52 |

Name | Age | Director Since | Experience | Committee Memberships | Other Public Company Boards |

Anita D. Britt * | 60 | 2018 | Former CFO of Perry Ellis International, Inc. | AC **, CC, ESG | 3 |

Fred M. Diaz * | 57 | 2021 | Former President and CEO of Mitsubishi Motor North America, Inc. | CC, ESG** | 3 |

Michelle J. Lohmeier* | 60 | 2023 | Former Strategic Advisor to CEO of Spirit AeroSystems, Inc. | CC, ESG | 2 |

Barry M. Monheit * | 76 | 2004 | Former President of Financial Consulting Division of FTI Consulting | CC **, NCG | 1 |

Robert L. Scott *§ | 77 | 1999 | Former President of a predecessor of Smith & Wesson Brands, Inc. | AC, NCG | 0 |

Mark P. Smith | 47 | 2020 | President and CEO of Smith & Wesson Brands, Inc. | - | 0 |

Denis G. Suggs * | 57 | 2021 |

CEO of LCP Transportation LLC

| AC, NCG** | 1 |

* = Independent Nominee; ** = Committee Chair;§ =Chairman

AC = Audit Committee; CC = Compensation Committee; ESG = Environmental, Social, and Governance Committee; NCG = Nominations and Corporate Governance Committee

| 2023 Proxy Statement I 1 |

Proxy Statement Summary | |

KEY ACCOMPLISHMENTS

Our key accomplishments for the fiscal year ended April 30, 2023 (“fiscal 2023”) include:

Continued Investments in Our Business In fiscal 2023, our capital allocation strategy continued to focus on investments in our business associated with the move of our headquarters and significant elements of our operations to Maryville, Tennessee (the “Relocation”). In fiscal 2023, we spent approximately $98 million in aggregate on the Relocation. Once the Relocation is completed, we will be positioned to deliver improved operating and financial performance, in part, due to the realization of certain distribution and manufacturing efficiencies. |

GOVERNANCE HIGHLIGHTS

Board Refreshment

We recognize the importance of board refreshment. Over 70% of our director nominees have joined our board of directors (the "Board") since 2018. This demonstrates the Board’s commitment to refreshment, including with independent nominees who provide perspectives and experience to support our strategy. Of our seven director nominees, two are women, one is a racial minority, and one is an ethnic minority.

Risk Oversight

Given the nature of our business, the Board remains focused on overseeing risk management. In addition to the Audit Committee receiving periodic presentations on enterprise risk management, during fiscal 2023, the Environmental, Social, and Governance Committee (the “ESG Committee”) discussed the campaign against the firearm industry at each of its meetings, and the full Board reviewed an updated report prepared by a third-party media monitoring firm that we have worked with for several years. During fiscal 2023, we also formalized a process whereby our Audit Committee Chair communicates directly with our Chief Compliance Officer at least quarterly in between scheduled Audit Committee meetings.

Stockholder Engagement

We recognize the importance of stockholder engagement. In addition to our regular, year-round stockholder engagement initiatives, prior to our annual meeting of stockholders held on September 12, 2022 (the “2022 Annual Meeting”), we met with certain of our largest stockholders to discuss, among other things, two stockholder proposals. In early 2023, we again met with certain of our largest stockholders. We used these meetings to, among other things, solicit our stockholders’ views on the right of stockholders to call special meetings (see Proposals 5 and 7) and our exclusive forum bylaw provision (see Proposal 6). We also engaged in April 2023 with our social activist stockholders (see Proposal 8).

COMPENSATION HIGHLIGHTS

Pay for Performance

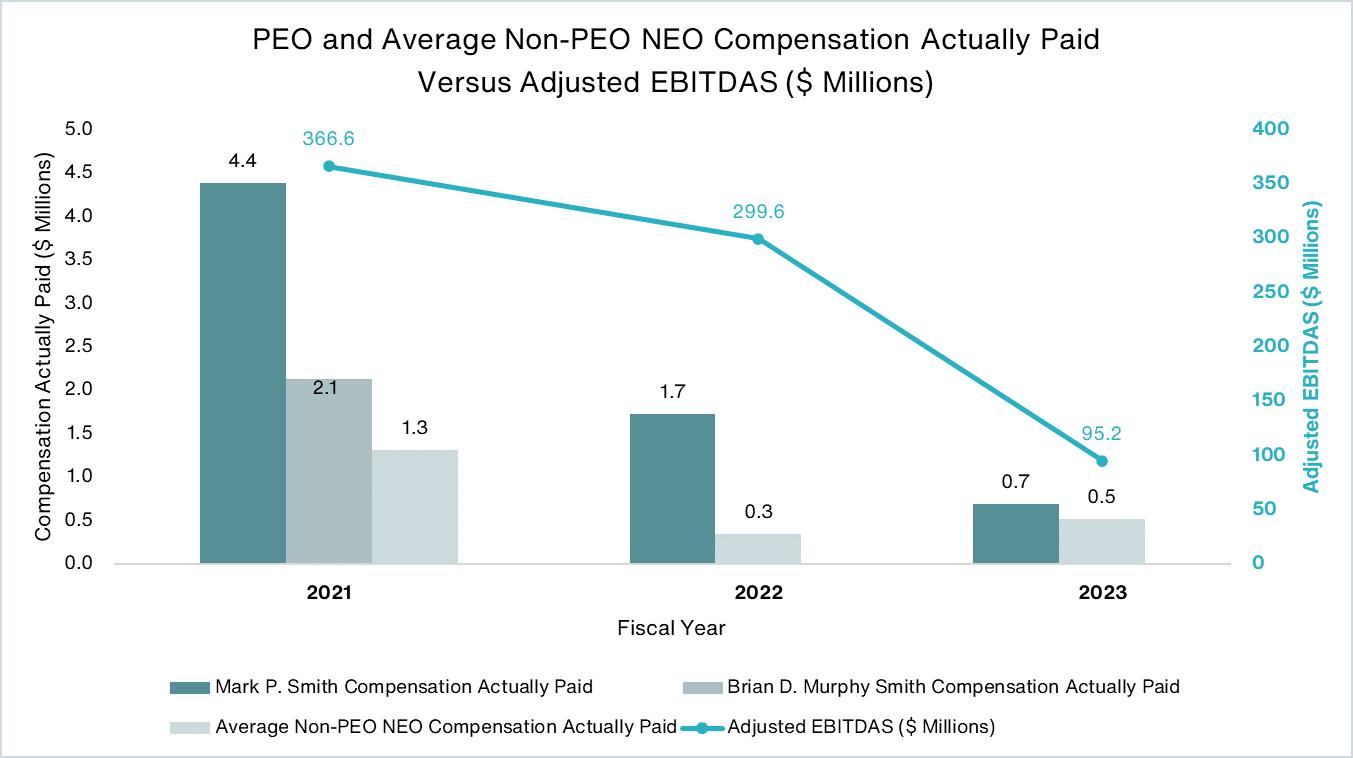

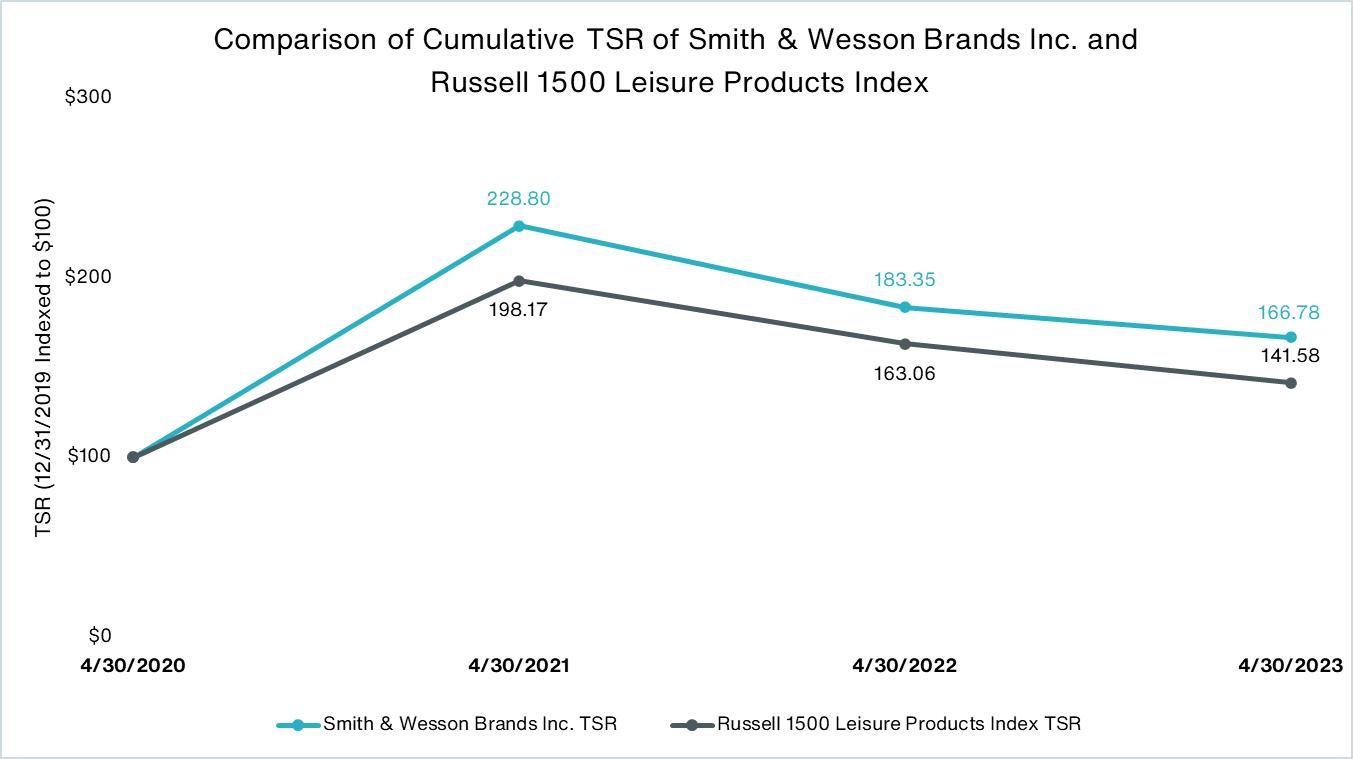

Our executive compensation program emphasizes our pay-for-performance philosophy. For fiscal 2023:

2 I 2023 Proxy Statement |

|

BOARD AND GOVERNANCE MATTERS

PROPOSAL One – election of directors | ||||

What Am I Voting On? Stockholders are being asked to elect each of the seven director nominees named in this Proxy Statement to hold office until the annual meeting of stockholders in 2024 (the “2024 Annual Meeting”) and until his or her successor is elected and qualified. | ||||

Voting Recommendation:FORthe election of each of the seven director nominees | ||||

Vote Required: A director will be elected if that director nominee receives a majority of the votes cast Broker Discretionary Voting Allowed? No – broker non-votes have no effect Abstentions: No effect |

GOVERNANCE FRAMEWORK

Our business and affairs are managed under the direction of the Board, subject to limitations and other requirements in our charter documents or in applicable statutes, rules, and regulations, including those of the Securities and Exchange Commission (the "SEC") and the Nasdaq Stock Market (“Nasdaq”).

Our governance framework supports independent oversight and accountability.

Independent Oversight | Accountability | |||

• 6 of 7 director nominees are independent • Non-Executive Chairman • All independent committees • Demonstrated commitment to Board refreshment – over 70% of the Board has joined since 2018 | • Majority voting in uncontested elections • Annual election of directors • Annual advisory say-on-pay vote • Robust over-boarding policy • Proxy access right |

Our governance framework is based on our Amended and Restated Bylaws (our “Bylaws”), as well as the key governance documents listed below:

Copies of these documents are available on our website, www.smith-wesson.com, or upon written request sent to our Corporate Secretary at our principal executive offices located at 2100 Roosevelt Avenue, Springfield, Massachusetts 01104. The information on our website is not part of this Proxy Statement.

| 2023 Proxy Statement I 3 |

Board and Governance Matters | |

BOARD COMPOSITION

Director Skills and Qualifications

The NCG Committee, using a matrix of director skills and experiences that the Board believes are needed to address existing and emerging business and governance issues relevant to us (the “Skills Matrix”), reviews with the Board annually the desired experiences, mix of skills, and other qualities required for new Board members, as well as Board composition. The Board seeks director candidates who possess the requisite judgment, background, skill, expertise, and time to strengthen and increase the breadth of skills and qualifications of the Board. In particular, the Board may consider, among other things, the fit of the individual’s skills, background, qualifications, experience, and personality with those of other directors in maintaining an effective, collegial, and responsive Board and a mix of diversity in personal and professional experience, background, viewpoints, perspectives, knowledge, and abilities.

Diversity Considerations. The Board does not have a specific diversity policy; however, as noted above, diversity is among the factors the NCG Committee may consider in connection with its annual review of desired experiences, mix of skills, and other qualities required for new Board members. We have posted a board diversity matrix on our website, www.smith-wesson.com, to comply with a Nasdaq rule. The information on our website is not part of this Proxy Statement. | Governance Spotlight Of our seven director nominees, two are women, one is a racial minority, and one is an ethnic minority. |

Skills Matrix. The NCG Committee developed the Skills Matrix in fiscal 2023 in response to requests from certain of our investors for more detailed information concerning our directors’ qualifications. The NCG Committee adopted the Skills Matrix to facilitate the comparison of our directors’ skills and experiences to those that the Board believes are needed to address existing and emerging business and governance issues relevant to us. The table below lists those skills and experiences, along with the total number of director nominees who possess the particular skill or experience.

Skill/Experience | Description | # of Director Nominees |

Executive | Experience serving as a CEO or a senior executive provides a practical understanding of a complex business like ours. | 7 of 7 |

Public Company Board | Service on other public company boards facilitates an understanding of corporate governance practices and trends, and insights into board management. | 5 of 7 |

Regulated Industry / Government | Experience with regulated industries and government provides insight and perspective in working constructively and proactively with government agencies. | 4 of 7 |

Sales and Marketing | Experience in sales, brand management, marketing, and marketing strategy provides a perspective on how to better market our products. | 3 of 7 |

Risk Management | Given the importance of the Board’s role in risk oversight, we seek directors who can help identify, manage, and mitigate key risks. | 6 of 7 |

Financial | Understanding financial reporting and accounting processes enables monitoring and assessment of operating and strategic performance and facilitates accurate financial reporting and robust controls. | 4 of 7 |

Manufacturing | Functional experience in a senior operating position with a manufacturing company can help us drive operating performance. | 6 of 7 |

Environmental, Social, and Governance | Experience with ESG matters, including sustainability, human capital management and corporate ethics, enables management of ESG risks and opportunities. | 3 of 7 |

4 I 2023 Proxy Statement |

|

Board and Governance Matters | |

Director Independence

Under the Guidelines and the Nasdaq listing standards, the Board must consist of a majority of independent directors. The Board annually reviews director independence and has determined that all director nominees, except for Mr. Smith (who is our President and CEO), are independent, as “independence” is defined by the SEC and the Nasdaq listing standards.

Board Refreshment

We recognize the importance of Board refreshment. Directors are elected each year at our annual meeting of stockholders to The Board has not established a mandatory retirement age; however, pursuant to the Guidelines, the Board and the NCG Committee review, in connection with the process of selecting nominees for election at annual stockholder meetings, each director’s continuation on the Board. |

| |

|

Michelle Lohmeier was appointed to the Of our |

|

|

|

|

|

|

|

|

|

|

|

| Board since 2018. |

These items of business are more fully described inThe Board has not established term limits; however, pursuant to the proxy statement accompanying this notice.

Only stockholders of recordGuidelines, the NCG Committee reviews each director’s continuation on the Board at least every three years, which, among other things, allows the close of business on August 4, 2021 are entitledBoard, through the NCG Committee, to notice of and to vote atconsider the meeting or any adjournment or postponement thereof.

All stockholders are cordially invited to attend the meeting and vote electronically during the meeting. To assure your representation at the meeting, however, you are urged to vote by proxy as soon as possible over the Internet as instructed in the Notice of Internet Availability of Proxy Materials or, if you receive paper copiesappropriateness of the proxy materials by mail, you can also vote by telephone or by mail by followingdirector’s continued service.

Director Nomination Process

The NCG Committee is responsible for identifying and evaluating Board nominees. In identifying candidates, the instructionsNCG Committee may take into account all factors it considers appropriate, which may include personal qualities and characteristics, individual character and integrity, mature judgment, career specialization, relevant technical skills and accomplishments, and the extent to which the candidate would fill a present need on the proxy card. You may vote electronically during the meeting even if you have previously given your proxy.Board.

Sincerely,

|

|

| |

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

| ||||

SMITH & WESSON BRANDS, INC.

2100 Roosevelt Avenue

Springfield, Massachusetts 01104

PROXY STATEMENT

General

Stockholder-Recommended Candidates. The enclosed proxy is being solicited on behalf of Smith & Wesson Brands, Inc., a Nevada corporation,NCG Committee will consider persons recommended by our stockholders for inclusion as Board nominees if the information required by our Bylaws is submitted in writing in a timely manner addressed and delivered to our Secretary.

Stockholder-Nominated Candidates. We have a “Proxy Access for Director Nominations” bylaw that permits a stockholder, or a group of Directors for use at our Annual Meeting of Stockholdersup to be held at 12:00 p.m., Eastern Time, on Monday, September 27, 2021,20 stockholders, owning 3% or at any adjournment or postponement thereof, for the purposes set forth in this proxy statement and in the accompanying notice. The Annual Meeting of Stockholders will be a virtual meeting. You will be able to attend the Annual Meeting of Stockholders during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/SWBI2021 and entering the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials.

In accordance with rules adopted by the Securities and Exchange Commission, or the SEC, that allow companies to furnish their proxy materials over the Internet, we are mailing a Notice of Internet Availability of Proxy Materials instead of a paper copymore of our proxy statementoutstanding common stock continuously for at least three years to nominate and our 2021 Annual Report to most of our stockholders. The Notice of Internet Availability of Proxy Materials contains instructions on how to access those documents and vote over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how to request a paper copy ofinclude in our proxy materials including our proxy statement, our 2021 Annual Report, and a formBoard nominees constituting up to two individuals or 20% of proxy card. We believe this process will allow us to provide our stockholders the information they need in a more timely manner, while reducing the environmental impact and lowering our costs of printing and delivering the proxy materials.

These proxy solicitation materials were first released on or about August 18, 2021 to all stockholders entitled to vote at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on September 27, 2021. These proxy materials, which include the notice of annual meeting, this proxy statement, and our 2021 Annual Report for the fiscal year ended April 30, 2021, are available at www.proxyvote.com.

How Does the Board of Directors Recommend That You Vote(whichever is greater), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in our Bylaws.

The Board of Directors recommends that you vote as follows:Majority Voting Standard

FOR the election of each of the nomineeOur directors (Proposal One);

| |

| |

FOR the advisory vote on the compensation of our named executive officers for fiscal 2021 (Proposal Two);

FOR the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accountant of our company for the fiscal year ending April 30, 2022 (Proposal Three);

FOR the approval of our 2021 Employee Stock Purchase Plan (Proposal Four); and

AGAINST approval of the stockholder proposal (Proposal Five).

Stockholders Entitled to Vote; Record Date; How to Vote

Stockholders of record at the close of business on August 4, 2021, which we have set as the record date, are entitled to notice of and to vote at the meeting. On the record date, there were outstanding 48,046,090 shares of our common stock. Each stockholder voting at the meeting, either electronically during the meeting orelected by proxy, may cast one vote per share of common stock held on all matters to be voted on at the meeting.

If, on August 4, 2021, your shares were registered directly in your name with our transfer agent, Issuer Direct Corporation, then you are a stockholder of record. As a stockholder of record, you may vote electronically during the meeting. Alternatively, you may vote by proxy over the Internet as instructed above or, if you receive paper copies of the proxy materials by mail, by using the accompanying proxy card or by telephone. Whether or not you plan to attend the meeting, we urge you to vote by proxy over the Internet as instructed in the Notice of Internet Availability of Proxy Materials or, if you receive paper copies of the proxy materials by mail, by filling out and returning the enclosed proxy card, or by telephone as instructed on the enclosed proxy card to ensure your vote is counted. Even if you have submitted a proxy before the meeting, you may still attend the meeting and vote electronically during the meeting.

If, on August 4, 2021, your shares were held in an account at a brokerage firm, bank, or similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the meeting. As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote the shares in your account. You should have received voting instructions with these proxy materials from that organization rather than from us. You should follow the instructions provided by that organization to submit your proxy. You are also invited to attend the meeting. However, since you are not the stockholder of record, you may not vote your shares electronically during the meeting unless you obtain a “legal proxy” from the broker, bank, or other nominee that holds your shares giving you the right to vote the shares at the meeting.

How to Attend the Meeting; Asking Questions

You are entitled to attend the meeting only if you were a stockholder of record at the close of business on August 4, 2021, which we have set as the record date, or you hold a valid proxy for the meeting. You may attend the meeting by visiting www.virtualshareholdermeeting.com/SWBI2021 and using your 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials to enter the meeting. If, on August 4, 2021, your shares were held in an account at a brokerage firm, bank, or similar organization, then you are the beneficial owner of shares held in “street name,” and you will be required to provide proof of beneficial ownership, such as your most recent account statement as of the record date, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership. If you do not comply with the procedures outlined above, you will not be admitted to the virtual annual meeting.

Stockholders who wish to submit a question for the meeting may do so live during the meeting at www.virtualshareholdermeeting.com/SWBI2021.

| |

| |

Quorum

The presence, in person or by proxy, of the holders of a majority of the total number of shares of common stock entitled to vote constitutes a quorum for the transaction of business at the meeting. Votes cast electronically during the meeting or by proxy at the meeting will be tabulated by the election inspector appointed for the meeting, who will determine whether a quorum is present.

Required Vote

Assuming that a quorum is present, the affirmative vote of a majority of the votes cast will be required for the election of each director nominee, to ratify the appointment of Deloitte & Touche LLP, an independent registered public accounting firm, as the independent registered public accountant of our company for the fiscal year ending April 30, 2022, to approve our 2021 Employee Stock Purchase Plan, and to approve the stockholder proposal. The advisory vote on the compensation of our named executive officers for fiscal 2021 (“say-on-pay”) is non-binding, but our Board of Directors will consider the input of stockholders based on a majority of votes cast for the say-on-pay proposal.

Broker Non-Votes and Abstentions

Brokers, banks, or other nominees that hold shares of common stockthem in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion if permitted by the stock exchange or other organization of which they are members. Brokers, banks, and other nominees are permitted to vote the beneficial owner’s proxy in their own discretion as to certain “routine” proposals when they have not received instructions from the beneficial owner, such as the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accountant of our company for the fiscal year ending April 30, 2022.uncontested elections. If a broker, bank, or other nominee votes such “uninstructed” shares for or against a “routine” proposal, those shares will be counted towards determining whether or not a quorum is present and are considered entitled to vote on the “routine” proposals. However, where a proposal is not “routine,” a broker, bank, or other nominee is not permitted to exercise its voting discretion on that proposal without specific instructions from the beneficial owner. These non-voted shares are referred to as “broker non-votes” when the nominee has voted on other non-routine matters with authorization or voted on routine matters. These shares will be counted towards determining whether or not a quorum is present, but will not be considered entitled to vote on the “non-routine” proposals.

Please note that brokers, banks, and other nominees may not use discretionary authority to vote shares on the election of directors, the say-on-pay proposal, the proposal to approve our 2021 Employee Stock Purchase Plan, or the stockholder proposal if they have not received specific instructions from their clients. For your vote to be counted in the election of directors, the say-on-pay proposal, the proposal to approve our 2021 Employee Stock Purchase Plan, and the stockholder proposal, you will need to communicate your voting decisions to your broker, bank, or other nominee before the date of the meeting.

As provided in our bylaws, a majority of the votes cast means that the number of shares voted “for” a nominee for election to our Board of Directors or any other proposal exceeds the number of shares voted “against” such nominee or other proposal. Because abstentions and broker non-votes do not represent votes cast “for” or “against” a proposal, abstentions and broker non-votes will have no effect on the election of directors, the say-on-pay proposal, the proposal to ratify the appointment of Deloitte & Touche LLP as the independent registered public accountant of our company for the fiscal year ending April 30, 2022, the proposal to approve our 2021 Employee Stock Purchase Plan, or the stockholder proposal, as each such proposal is determined by reference to the votes actually cast by the shares present in person or by proxy at the meeting and entitled to vote.

In accordance with our director resignation policy, an incumbent director who does not receive the requisite majority of votes cast, in an uncontested electionthen the director is expected to submit his or her resignation to the Board. Based on the recommendation of the NCG Committee, the Board would determine whether to accept the resignation and would publicly disclose its decision and its rationale. A director who tenders his or her offer of resignation to our Board of Directors. Our Board of Directors, upon recommendation of the Nominations and Corporate Governance Committee, will make a determination as to whether to accept or reject the offered resignation

| |

| |

within 90 days after the stockholder vote. A director whose offered resignation is under consideration willwould abstain from any decision or recommendation regarding the offered resignation, but will otherwise continue to serve as a director until our Board of Directors makes its determination regarding the offered resignation. We will publicly disclose our Board of Directors’ decision regarding the tendered resignation and the rationale behind the decision in a filing of a Current Report on Form 8-K with the SEC.

Voting of Proxies

When a proxy is properly executed and returned, the shares it represents will be voted at the meeting as directed. Except as provided above under “Broker Non-Votes and Abstentions,” if no specification is indicated, the shares will be voted (1) “for” the election of each of the eight director nominees set forth in this proxy statement, (2) “for” the approval of the compensation of our named executive officers for fiscal 2021, (3) “for” the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accountant of our company for the fiscal year ending April 30, 2022, (4) “for” the approval of our 2021 Employee Stock Purchase Plan, and (5) “against” the stockholder proposal. If any other matter is properly presented at the meeting, the individuals specified in the proxy will vote your shares using their best judgment.

Revocability of Proxies

Any person giving a proxy may revoke the proxy at any time before its use by delivering to us either a written notice of revocation or a duly executed proxy bearing a later date or by attending the meeting and voting electronically during the meeting (as provided under “Stockholders Entitled to Vote; Record Date; How to Vote”). Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

Solicitation

We will bear the cost of this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by certain of our directors and officers, personally or by telephone or e-mail, without additional compensation.

We have retained Morrow Sodali LLC, a proxy solicitation firm, to perform various solicitation services in connection with the Annual Meeting of Stockholders. We will pay Morrow Sodali a fee of $10,000, plus phone and other related expenses, in connection with its solicitation services. Morrow Sodali has engaged approximately 15 of its employees to assist us in connection with the solicitation of proxies.

Annual Report and Other Matters

Our 2021 Annual Report to Stockholders, which was made available to stockholders with or preceding this proxy statement, contains financial and other information about our company, but is not incorporated into this proxy statement and is not to be considered a part of these proxy materials or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The information contained in the “Compensation Committee Report” and the “Report of the Audit Committee” shall not be deemed “filed” with the SEC or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act.

We will provide, without charge, a copy of our Annual Report on Form 10-K for the fiscal year ended April 30, 2021 as filed with the SEC to each stockholder of record as of the record date that requests a copy in writing. Any exhibits listed in our Annual Report on Form 10-K also will be furnished upon request at the actual expense we incur in furnishing such exhibits. Any such requests should be directed to our Secretary at the address of our executive offices set forth in this proxy statement.

5 I 2023 Proxy Statement |

|

Board and Governance Matters | |

|

Over-Boarding Policy

Executive Officer and Director Changes

Our directors may not serve on more than three other public company boards, unless it is determined, based on the individual facts, that such service will not interfere with service on the Board. In connection with the previously announced spin-offevaluation of these facts, the Chairman of the Board and Chair of the NCG Committee will consider the time commitment required by the director’s service, if any, in leadership positions (e.g., board chair, committee chair, lead independent director, etc.) on the Board and any other public company board of directors. None of our outdoor productsdirector nominees serves on more than three other public company boards and accessories business, orour CEO does not serve on any other public company board. The NCG reviews annually the Separation, to American Outdoor Brands, Inc., or AOUT, our Board of Directors appointed Mark P. Smith, formerly Co-President and Co-Chief Executive Officertime commitments of our company, as President and Chief Executive Officer andindependent directors.

Director Nominees

The Board currently has eight members. Pursuant to the recommendation of the NCG Committee, the Board has nominated each current director for election at the 2023 Annual Meeting, except for Mr. Furman, who, after many years of distinguished service to the Board, is retiring from the Board effective at the 2023 Annual Meeting. Ms. Lohmeier, who was appointed to the Board in July 2023, was first identified as a director of our companycandidate by a third-party search firm and appointed Deana L. McPherson, formerly Vice President, Chief Accounting Officer, Corporate Controller, and Assistant Treasurer of our company, as Executive Vice President, Chief Financial Officer, Treasurer, and Assistant Secretary of our company. Susan J. Cupero was named an executive officer of our company on June 23, 2021. Effective August 24, 2020, in connection with the Separation, Brian D. Murphy resigned as Co-President and Co-Chief Executive Officer of our company to serve as the President and Chief Executive Officer of AOUT as a new independent, publicly traded company; and Gregory J. Gluchowski, Jr. and I. Marie Wadecki resigned from our Board of Directors to become directors of AOUT. In connection with the Separation, Jeffrey D. Buchanan, who served as Executive Vice President, Chief Financial Officer, Chief Administrative Officer, and Treasurer of our company, formalized his previously announced retirement from our company as of the close of business on August 23, 2020. Effective August 1, 2020, Lane A. Tobiassen, former President, Firearm division of our company, separated from our company. Effective August 1, 2021, Robert J. Cicero retired as Senior Vice President, General Counsel, Chief Compliance Officer, and Secretary of our company. Mitchell A. Saltz served on our Board of Directorswill stand for many years until his death in October 2020.

The Separation

On August 24, 2020, we completed the Separation and AOUT became an independent, publicly traded company holding, directly or indirectly through its subsidiaries, the assets and legal entities, subject to any related liabilities, associated with the former outdoor products and accessories business of our company. The Separation was completed by way of a pro rata distribution, or the Distribution, of all the outstanding shares of AOUT common stock to the stockholders of record of our company as of the close of business on August 10, 2020, the record datestockholder election for the Distribution, orfirst time at the Record Date. Each stockholder of our company received one share of AOUT common stock for every four shares of common stock of our company held by such stockholder as of the close of business on the Record Date. The distribution of these shares was made in book-entry form, which means that no physical share certificates were delivered.

Name Change

In preparation for the Separation, we changed our name to Smith & Wesson Brands, Inc. on May 29, 2020. During fiscal 2021, the management and the Board of Directors of our company devoted significant time and attention to reorganize and restructure our company in preparation for the Separation.

| |

| |

Adjustments to Outstanding Stock-Based Awards

In connection with the Separation, our outstanding stock-based awards, including restricted stock units, or RSUs, and performance-based restricted stock units, or PSUs, were adjusted in a manner intended to maintain the intrinsic value of the RSUs and PSUs immediately prior to the Separation. The RSUs and PSUs held by our directors and executives generally were converted into RSUs or PSUs of our company and AOUT, such that2023 Annual Meeting. If elected, each such holder would (i) continue to hold the existing RSU or PSU in our company covering the same number of shares of our common stock that were subject to the RSU or PSU prior to the Separation and (ii) receive an identical RSU or PSU covering one share of AOUT common stock for each four shares of our common stock covered by the RSU or PSU in our company, resulting in the RSUs or PSUs for our company, and AOUT, having a combined intrinsic value immediately after the Separation as before the Separation, taking into account any necessary adjustments to the exercise price (if any) to maintain such intrinsic value. In addition, to the extent the existing award of our company is subject to the achievement of certain company performance-based target goals, appropriate adjustmentsdirector nominee will be made to such target goals and incorporated into the new awards to reflect the changes to the businesses of each of our company and AOUT as a result of the Separation. The number of shares covered by RSUs in our company held by other employees were adjusted so that the RSUs had the same intrinsic value immediately following the Separation as before the Separation. To the extent the existing award of our company is subject to vesting based upon continued service with our company, the new awards will also remain subject to the same vesting conditions based upon continued employment with the holder’s post-Separation employer.

| |

Nominees

Our articles of incorporation and bylaws provide that the number of directors shall be fixed from time to time by resolution of our Board of Directors. The number of directors is currently fixed at eight. Our articles of incorporation and bylaws provide that all directors are elected at each annual meeting of our stockholders for a term of one year and hold office until their successors arethe 2024 Annual Meeting and until his or her successor is elected and qualified.

A board of eight directors is to be elected at this meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them “for” each of the nominees named below. All of the nominees currently are directors of our company. In the event that If any director nominee is unable or declines to serve as a director at the time of the meeting,2023 Annual Meeting, the proxies will be voted for any nominee designated by our current Board of Directors to fill the vacancy. It isWe do not expectedexpect that any director nominee will be unable or will decline to serve as a director.

Set forth below is information about each director nominee, including a description of his or her qualifications to serve on the Board and a listing of certain key skills and experiences from the Skills Matrix possessed by each director nominee.

|

The following table sets forth certain information regarding the nominees for directors of our company:

|

|

| |||

Director since:2018 Independent Board committees: • Audit • Compensation • ESG Other public company boards: • Delta Apparel, Inc. • urban-gro, Inc. • VSE Corporation Other public company boards within five years: • None | Background: Ms. Britt served as CFO of Perry Ellis International, Inc. from 2009 to 2017 and held senior financial leadership positions at Jones Apparel Group, Inc. (1993 to 2006) and Urban Brands, Inc. (2006 to 2009). Ms. Britt is a CPA and a member of the American Institute of Certified Public Accountants. She is also a Board Leadership Fellow, as designated by the National Association of Corporate Directors. Ms. Britt holds a Carnegie Mellon Cybersecurity Oversight Certification and a Harvard Kennedy School Executive Education Certificate in Cybersecurity: The Intersection of Policy and Technology. | ||||

Key Qualifications and Skills Include: Financial. Extensive corporate finance, investor relations, and capital markets experience gained through service as a public company CFO and other senior financial roles; certified public accountant Public Company Board. Service on three other boards (see related caption) Risk Management. Certified public accountant; former public company CFO; holds multiple cybersecurity certifications (see above) | |||||

6 I 2023 Proxy Statement |

|

Board and Governance Matters | |

FRED M. DIAZ | |

Age:57 Director since:2021 Independent Board committees: • Compensation • ESG Other public company boards: • Archer Aviation Inc. • SiteOne Landscape Supply, • Valero Energy Corporation Other public company boards within five years: • None | Background: Mr. Diaz served as President and CEO of Mitsubishi Motor North America, Inc. from 2018 to 2020 and as General Manager, Performance Optimization Global Marketing and Sales of Mitsubishi Motors Corporation in Tokyo, Japan from 2017 to 2018. He served in various executive level positions with Nissan North America Inc. for four years and Chrysler Corporation LLC for 24 years, including as the President and CEO of the Ram Truck Brand and Chrysler of Mexico. |

Key Qualifications and Skills Include: Executive. Former President and CEO of Mitsubishi Motor North America, the Ram Truck Brand, and Chrysler of Mexico Manufacturing. Extensive operations experience gained through service as executive of multinational manufacturers, including Mitsubishi and Chrysler Public Company Board. Service on three other boards (see related caption) Sales and Marketing. Former SVP, Sales & Marketing and Operations USA for Nissan North America and Head of National Sales of Ram Truck Brand | |

MICHELLE J. LOHMEIER | |

Age:60 Director since:2023 Independent Board committees: • Compensation • ESG Other public company boards: • Kaman Corp. • Mistras Group, Inc. Other public company boards within five years: • None | Background: Ms. Lohmeier has been a director since July 2023. She is a former senior advisor to the CEO of Spirit AeroSystems Holdings, Inc. having served in that position from 2019 to 2021. Prior to that, she had served as SVP and General Manager of Airbus Programs at Spirit AeroSystems. Before joining Spirit AeroSystems, Ms. Lohmeier held senior positions at Raytheon Company, including VP of the Land Warfare Systems product line at Raytheon Missile Systems. Previously, she was the program director at Raytheon for the design, development, and production implementation of the Standard Missile-6 weapon system for the U.S. Navy. She began her career with Hughes Aircraft Company as a system test engineer in 1985. |

Key Qualifications and Skills Include: Manufacturing. Extensive operations experience gained through roles with Spirit AeroSystems, Raytheon, and Hughes Aircraft Public Company Board. Service on two other boards (see related caption) Regulated Industry/Government. Extensive experience in the highly regulated aerospace and defense industries | |

BARRY M. MONHEIT | |

Age:76 Director since:2004 Independent Board committees: • Compensation • NCG Other public company boards: • American Outdoor Brands, Inc. Other public company boards within five years: • None | Background: Mr. Monheit served as Chairman of the Board |

Executive. Former CEO of Quest Resource; Division President of FTI Consulting; and partner of Arthur Andersen Financial. Retired certified public accountant; former partner of Public Company Board. Current Chairman of American Outdoor Brands, Inc. | |

7 I 2023 Proxy Statement |

|

Board and Governance Matters |

|

ROBERT L. SCOTT | |||||

Age:77 Director since:1999 Independent Board committees: • Audit • NCG Other public company boards: • None Other public company boards within five years: • None |

Mr. Scott has served as our Chairman since 2020. He also serves as Chairman of the | ||||

| Executive. Our former President, VP of Sales and Marketing, and |

| Regulated Industry/Government. Extensive leadership experience in |

Primos Hunting, and OPT Holdings Sales and Marketing. Our former VP of Sales and Marketing; previously served in senior sales roles with Berkley and Tasco Sales | |

|

|

| |||

Director since:2020 Not Independent Board committees: • None Other public company boards: • None Other public company boards within five years: • None | Background: |

| Mr. Smith has served as our President and CEO and as a director since August 2020. Since joining us in 2010, he has served in a number of roles with increasing responsibility, including Vice President of Supply Chain Management (2010 to 2011), Vice President of Manufacturing and Supply Chain Management (2011 to 2016), President, Manufacturing Services (2016 to 2020), and Co-President and Co-Chief Executive Officer (January 2020 to August 2020). Prior to joining us, Mr. Smith served as Director | ||

Executive. Our President and CEO Manufacturing. Extensive operations experience gained through roles with us, including as President, Manufacturing Services and VP of Manufacturing and Supply Chain Management, and Alvarez & Marsal Regulated Industry/Government. Extensive leadership experience in firearm industry through affiliation with us | |||||

8 I 2023 Proxy Statement |

|

Board and Governance Matters |

|

| |

|

|

| |||

Director since:2021 Independent Board committees: • Audit • NCG Other public company boards: • Patrick Industries Other public company boards within five years: • None | Background: |

|

| |

|

|

|

|

|

|

|

|

Public Storage Inc. | |

ESG. Experience as President and CEO of Strategic Materials, a leading glass and plastics recycler, as well as through service on board of directors of Glass Packaging Institute, which focuses on sustainability issues Manufacturing. Extensive operations experience gained through service as executive of Belden and Danaher Regulated Industry/Government. Experience as CEO of LCP Transportation, which operates in a heavily regulated industry, as well as leading organizations that serve highly regulated sectors, such as aerospace and defense |

| |

| ||

Age: 75BOARD AND COMMITTEE GOVERNANCE

Tenure: Since 1999

Committee: Audit Committee and Nominations and Corporate Governance Committee

Independent

Robert L. Scott has served as a director of our company since December 1999 and was appointed as Chairman of the Board on August 23, 2020. Mr. Scott is the Chairman of the National Shooting Sports Foundation and a Governor of the Sporting Arms and Ammunition Institute. Mr. Scott served as a consultant to our company from May 2004 until February 2006; President of our company from December 1999 until September 2002; Chairman of our wholly owned subsidiary, Smith & Wesson Corp., from January 2003 through December 2003; and President of Smith & Wesson Corp. from May 2001 until December 2002. From December 1989 to December 1999, Mr. Scott served as Vice President of Sales and Marketing and later as Vice President of Business Development of Smith & Wesson Corp. prior to its acquisition by our company. Prior to joining Smith & Wesson Corp., Mr. Scott was employed for eight years in senior positions with Berkley & Company and Tasco Sales Inc., two leading companies in the outdoor industry. Mr. Scott previously served as a director and a member of the Compensation Committee of OPT Holdings, a private company marketing hunting accessories. We believe Mr. Scott’s prior extensive service with our company and his very extensive industry knowledge and expertise provide the requisite qualifications, skills, perspectives, and experience that make him well qualified to serve on our Board of Directors.

| ||

Age: 67

Tenure: Since 2004

Committee: Environmental, Social, and Governance Committee

Independent

Michael F. Golden has served as a director of our company since December 2004 and was appointed Vice Chairman of the Board on August 23, 2020. Mr. Golden served as the President and Chief Executive Officer of our company from December 2004 until his retirement in September 2011. Mr. Golden served on the board of directors of Quest Resource Holding Corporation, a publicly traded environmental solutions company that serves as a single source provider of recycling and environment-related programs, services, and information, from October 2012 to March 2021. Mr. Golden was employed in various executive positions with the Kohler Company from February 2002 until joining our company, with his most recent position being the President of its Cabinetry Division. Mr. Golden was the President of Sales for the Industrial/Construction Group of the Stanley Works Company from 1999 until 2002; Vice President of Sales for Kohler’s North American Plumbing Group from 1996 until 1998; and Vice President — Sales and Marketing for a division of The Black & Decker Corporation where he was employed from 1981 until 1996. Since February 2013, Mr. Golden has served as a member of the board of directors of Trex Company, Inc., a New York Stock Exchange-listed manufacturer of high-performance wood-alternative decking and railing, and serves as a member of the Nominating/Corporate Governance Committee and Chairman of the Compensation Committee. We believe Mr. Golden’s service as the former President and Chief Executive Officer of our company, his intimate knowledge and experience with all aspects of the operations, opportunities, and challenges of our company, and his long business career at major companies provide the requisite qualifications, skills, perspectives, and experience that make him well qualified to serve on our Board of Directors.

| |

| |

| ||

Age: 58

Tenure: Since 2018

Committee: Audit Committee, Compensation Committee, and Environmental, Social, and Governance Committee

Independent

Anita D. Britt has served as a director of our company since February 2018. Ms. Britt served as Chief Financial Officer for Perry Ellis International, Inc., a publicly traded apparel company, from March 2009 until her retirement in March 2017. From August 2006 to February 2009, Ms. Britt served as Executive Vice President and Chief Financial Officer of Urban Brands, Inc., a privately held apparel company. From 1993 to 2006, Ms. Britt served in various positions, including that of Executive Vice President, Finance, for Jones Apparel Group, Inc., an apparel company. Ms. Britt has served as a member of the Board of Directors since 2018 and is a member of the Audit Committee and the Corporate Governance Committee of Delta Apparel, Inc., a New York Stock Exchange-listed designer, manufacturer, and marketer of lifestyle basics and branded active wear apparel, headwear, and related accessory products. Ms. Britt has served as a member of the Board of Directors, the chair of the Audit Committee, and a member of the Compensation Committee and Nominations and Corporate Governance Committee since June 2021 of urban-gro, Inc. a Nasdaq-listed provider of integrated design, engineering, and cultivation systems for the indoor horticulture market. Ms. Britt previously served on the Board of Trustees and Finance Committee of St. Thomas University from April 2013 to January 2018 and as its Chief Financial Officer from January 2018 to March 2018. Ms. Britt is a Certified Public Accountant and is a member of the American Institute of Certified Public Accountants and the Pennsylvania Institute of Certified Public Accountants. Ms. Britt is also a Board Leadership Fellow, as designated by the National Association of Corporate Directors. We believe Ms. Britt’s extensive financial leadership at a number of public and private companies and her extensive experience with consumer-oriented companies provide the requisite qualifications, skills, perspectives, and experience that make her well qualified to serve on our Board of Directors.

| ||

Age: 55

Tenure: Since 2021

Committee: Compensation Committee and Environmental, Social, and Governance Committee

Independent

Fred M. Diaz has served as a director of our company since May 2021. Mr. Diaz served as President and Chief Executive Officer of Mitsubishi Motor North America, Inc. from 2018 to 2020 and as General Manager, Performance Optimization Global Marketing and Sales of Mitsubishi Motors Corporation in Tokyo, Japan from 2017 to 2018. Mr. Diaz served in various executive level positions with Nissan North America Inc. for four years and Chrysler Corporation LLC for 24 years as the President and Chief Executive Officer of both the Ram Truck Brand and Chrysler of Mexico. Mr. Diaz currently serves on the board of directors of SiteOne Landscape Supply, Inc., a publicly owned company that is the largest and only national wholesale distributor of landscaping products in the United States and Canada. We believe Mr. Diaz’s executive positions, including that of chief executive officer for multiple companies, his management and marketing experience, and his experience as a public company director provide the requisite qualifications, skills, perspectives, and experience that make him well qualified to serve on our Board of Directors.

| |

| |

| ||

Age: 77

Tenure: Since 2004

Committee: Audit Committee, Nominations and Corporate Governance Committee, and Compensation Committee

Independent

John B. Furman has served as a director of our company since April 2004. Since leaving the practice of law in August 1998, Mr. Furman has served as a consultant to or an executive of a number of companies, including serving as the chief executive officer of two public companies, with his focus being on restructurings, business transactions, capital formation, and product commercialization. From February 2009 until December 2009, Mr. Furman was the President and Chief Executive Officer of Infinity Resources LLC (now Quest Resource Holding Corporation), a privately held environmental solutions company that served as a single-source provider of recycling programs. Mr. Furman served as President and Chief Executive Officer of GameTech International, a publicly traded company involved in interactive bingo systems, from September 2004 until July 2005. Mr. Furman served as President and Chief Executive Officer and a director of Rural/Metro Corporation, a publicly traded provider of emergency and fire protection services, from August 1998 until January 2000. Mr. Furman was a senior member of the law firm of O’Connor, Cavanagh, Anderson, Killingsworth & Beshears, a professional association, from January 1983 until August 1998; he was Associate General Counsel of Waste Management, Inc., a New York Stock Exchange- listed provider of waste management services, from May 1977 until December 1983; and Vice President, Secretary, and General Counsel of the Warner Company, a New York Stock Exchange-listed company involved in industrial mineral extractions and processing, real estate development, and solid and chemical waste management, from November 1973 until April 1977. Mr. Furman previously served as a director and Chairman of the Compensation Committee of MarineMax, Inc., a New York Stock Exchange-listed company that is the nation’s largest recreational boat dealer. We believe Mr. Furman’s experience as a chief executive officer and a consultant to multiple companies, his experience as a lawyer in private practice and for corporations, and his experience as a public company director provide the requisite qualifications, skills, perspectives, and experience that make him well qualified to serve on our Board of Directors.

| |

| |

| ||

Age: 74

Tenure: Since 2004

Committee: Nominations and Corporate Governance Committee and Compensation Committee

Independent

Barry M. Monheit has served as a director of our company since February 2004, including as Chairman of the Board from October 2004 until the Separation when he became Chairman of the Board of AOUT. Mr. Monheit has served as Chairman of the Board of American Outdoor Brands, Inc., a publicly traded outdoor products and accessories company and our former subsidiary, since its spin-off from our company in August 2020. Mr. Monheit has been, since July 1, 2020, a Senior Managing Director of J.S Held, LLC, formerly Simon Consulting, L.L.C., a consulting company providing services in forensic accounting, fraud investigations, receivership and restructuring, and lost profit examinations. Mr. Monheit has been, since December 2015, Vice Chairman of the Board of That’s Eatertainment Corp. (formerly Modern Round Entertainment Corporation), a company formed to create and roll out nationally an entertainment concept centered around a virtual interactive shooting experience utilizing laser technology-based replica firearms and extensive food and beverage offerings, and was a principal of its predecessor, Modern Round LLC, from February 2014 until December 2015. Mr. Monheit served as the President and Chief Executive Officer of Quest Resource Holding Corporation, a publicly traded environmental solutions company that serves as a single-service provider of recycling and environment-related programs, services, and information, from June 2011 until July 2013 and served as a director of that company or its predecessors from June 2011 until July 2019. Mr. Monheit served as a financial and operational consultant from April 2010 until June 2011. From May 2009 until April 2010, Mr. Monheit was a Senior Managing Director of FTI Palladium Partners, a financial consulting division of FTI Consulting, Inc., a New York Stock Exchange-listed global advisory firm dedicated to helping organizations protect and enhance enterprise value in an increasingly complex legal, regulatory, and economic environment. Mr. Monheit was a consultant focusing on financial and operational issues in the corporate restructuring field from January 2005 until May 2009. From July 1992 until January 2005, Mr. Monheit was associated in various capacities with FTI Consulting, Inc., serving as the President of its Financial Consulting Division from May 1999 through November 2001. Mr. Monheit was a partner with Arthur Andersen & Co. from August 1988 until July 1992, serving as partner-in-charge of its New York Consulting Division and partner-in-charge of its U.S. Bankruptcy and Reorganization Practice. We believe Mr. Monheit’s extensive experience in financial and operational consulting gained as an executive of major restructuring firms and his executive experience with major and emerging companies provide the requisite qualifications, skills, perspectives, and experience that make him well qualified to serve on our Board of Directors.

| |

| |

| ||

Age: 45

Tenure: Since 2020

Committee: Not Applicable

Not Independent

Mark P. Smith has served as President and Chief Executive Officer and as a director of our company since August 2020. Mr. Smith served as Co-President and Co-Chief Executive Officer of our company from January 2020 until August 2020. Mr. Smith served as President, Manufacturing Services of our company and as President of Manufacturing Services for Smith & Wesson Sales Company (formerly known as American Outdoor Brands Sales Company and Smith & Wesson Corp.), a subsidiary of our company, from March 2016 until January 2020. Mr. Smith served as Vice President of Manufacturing and Supply Chain Management from May 2011 until March 2016 and served as Vice President of Supply Chain Management from May 2010 until May 2011. He was Director Supply Chain Solutions for Alvarez & Marsal Business Consulting, LLC from April 2007 until April 2010. Mr. Smith held various positions for Ecolab, Inc., a developer and marketer of programs, products, and services for the hospitality, foodservice, healthcare, industrial, and energy markets, from March 2001 until April 2007, including Program Manager, Acquisition Integration Manager, Senior Manufacturing Planner, Plant Engineer, and Senior Production / Quality Supervisor. Mr. Smith was a Production Supervisor for Bell Aromatics, a manufacturer of flavors and fragrances, from August 1999 until March 2001. We believe Mr. Smith’s position as President and Chief Executive Officer of our company, as President, Manufacturing Services of our company, as President of Manufacturing Services for Smith & Wesson Sales Company, his experience in marketing and supply chain management for various companies, and other executive positions with various companies provide the requisite qualifications, skills, perspectives, and experiences that make him well qualified to serve on our Board of Directors.

| ||

Age: 55

Tenure: Since 2021

Committee: Audit Committee and Nominations and Corporate Governance Committee

Independent

Denis G. Suggs has served as a director of our company since May 2021. Mr. Suggs has served as the Chief Executive Officer of LCP Transportation LLC, a non-emergency medical transportation provider, since 2020. Mr. Suggs served as President and Chief Executive Officer of Strategic Materials, Inc., a glass recycler, from 2014 to 2020. Mr. Suggs previously served in executive capacities with Belden, Inc., Danaher Corporation, and Public Storage Inc. Mr. Suggs currently serves on the board of Patrick Industries, a publicly owned company that is a major manufacturer of components, building products and materials for the recreation vehicle, marine, manufactured housing, and industrial markets in the United States and Canada. We believe Mr. Suggs’ executive positions, including that of chief executive officer for multiple companies, his managerial experience, and his experience as a public company director make him well qualified to serve on our Board of Directors.

There are no family relationships among any of our directors and executive officers.

| |

Director Independence

Our Board of Directors has determined, after considering all of the relevant facts and circumstances, that Anita D. Britt, Fred M. Diaz, John B. Furman, Michael F. Golden, Barry M. Monheit, Robert L. Scott, and Denis G. Suggs are independent directors, as “independence” is defined by the listing standards of the Nasdaq Stock Market, or Nasdaq, and by the SEC, because they have no relationship with us that would interfere with their exercise of independent judgment in carrying out their responsibilities as a director. Mark P. Smith is an employee director. Gregory J. Gluchowski, Jr., and I. Marie Wadecki served on our Board of Directors during a portion of fiscal 2021. Mr. Gluchowski and Ms. Wadecki resigned from our Board of Directors in August 2020 in connection with the Separation to join the Board of Directors of AOUT as provided for in the Separation. Mr. Gluchowski and Ms. Wadecki were independent directors, as “independence” is defined by the listing standards of Nasdaq and by the SEC, because they had no relationship with us that would interfere with their exercise of independent judgment in carrying out their responsibilities as a director.

Committee Charters, Corporate Governance Guidelines, and Codes of Conduct and Ethics

Our Board of Directors has adopted charters for the Audit; Compensation; Nominations and Corporate Governance; and Environmental, Social, and Governance Committees describing the authority and responsibilities delegated to each committee by our Board of Directors. Our Board of Directors has also adopted Corporate Governance Guidelines, a Code of Conduct, and a Code of Ethics for the CEO and Senior Financial Officers. We post on our website, at www.smith-wesson.com, the charters of our Audit; Compensation; Nominations and Corporate Governance; and Environmental, Social, and Governance Committees; our Corporate Governance Guidelines, Code of Conduct, and Code of Ethics for the CEO and Senior Financial Officers, and any amendments or waivers thereto; and any other corporate governance materials specified by SEC or Nasdaq regulations. These documents are also available in print to any stockholder requesting a copy in writing from our Secretary at the address of our executive offices set forth in this proxy statement.

Policy on Corporate Political Contributions and Expenditures

Our Board of Directors has adopted a Policy on Corporate Political Contributions and Expenditures which is posted on our website at www.smith-wesson.com. In accordance with this policy, for each fiscal year beginning in 2015, we have posted on our website during the applicable fiscal year an annual report disclosing all political contributions or expenditures in the United States that are not deductible as “ordinary and necessary” business expenses under Section 162(e) of the Internal Revenue Code in excess of $50,000. Non-deductible amounts generally include contributions to or expenditures in support of or opposition to political candidates, political parties, or political committees.

Executive Sessions

We regularly schedule executive sessions in which independent directors meet without the presence or participation of management. The Chairman of our Board of Directors serves as the presiding director of such executive sessions.

| |

| |

Board Committees

Our bylaws authorize our Board of Directors to appoint from among its members one or more committees consisting of one or more directors. Our Board of Directors has established an Audit Committee; a Compensation Committee; a Nominations and Corporate Governance Committee; and an Environmental, Social, and Governance Committee, each consisting entirely of independent directors as “independence” is defined by the listing standards of Nasdaq and by the SEC.

The Audit Committee

The purpose of the Audit Committee includes overseeing the financial and reporting processes of our company and the audits of the financial statements of our company and providing assistance to our Board of Directors with respect to its oversight of the integrity of the financial statements of our company, our company’s compliance with legal and regulatory matters, our company’s policies and practices related to information security, the independent registered public accountant’s qualifications and independence, and the performance of our company’s independent registered public accountant. The primary responsibilities of the Audit Committee are set forth in its charter and include various matters with respect to the oversight of our company’s accounting and financial reporting process and audits of the financial statements of our company on behalf of our Board of Directors. The Audit Committee also selects the independent registered public accountant to conduct the annual audit of the financial statements of our company; reviews the proposed scope of such audit; reviews accounting and financial controls of our company with the independent registered public accountant and our financial accounting staff; and reviews and approves any transactions between us and our directors, officers, and their affiliates, also referred to as related-person transactions.

The Audit Committee currently consists of Messrs. Furman, Scott, and Suggs and Ms. Britt, with Ms. Britt serving as the chair. Our Board of Directors has determined that each of Messrs. Furman, Scott, and Suggs and Ms. Britt, whose backgrounds are described above, qualifies as an “audit committee financial expert” in accordance with applicable rules and regulations of the SEC. During a portion of fiscal 2021, Ms. Wadecki also served on the Audit Committee before joining the Board of Directors of AOUT. Mr. Suggs was appointed to the Audit Committee following fiscal 2021 in connection with his appointment to our Board of Directors.

The Compensation Committee

The purpose of the Compensation Committee includes determining, or, when appropriate, recommending to our Board of Directors for determination, the compensation of the Chief Executive Officer and other executive officers of our company and discharging the responsibilities of our Board of Directors relating to compensation programs of our company. The Compensation Committee currently makes all decisions with respect to executive compensation. The Compensation Committee currently consists of Messrs. Diaz, Furman, and Monheit and Ms. Britt with Mr. Monheit serving as the chair. During a portion of fiscal 2021, Mr. Gluchowski and Ms. Wadecki also served on the Compensation Committee before joining the Board of Directors of AOUT, and Mr. Furman served as chair of the Compensation Committee, until the Separation. Mr. Diaz was appointed to the Compensation Committee following fiscal 2021 in connection with his appointment to our Board of Directors.

The Nominations and Corporate Governance Committee

The purpose of the Nominations and Corporate Governance Committee includes the selection or recommendation to our Board of Directors of nominees to stand for election as directors at each election of directors, the oversight of the selection and composition of committees of our Board of Directors, the oversight of the evaluations of our Board of Directors and management, and the development and recommendation to our Board of Directors of corporate governance principles applicable to our company. The Nominations and Corporate Governance Committee currently consists of Messrs. Furman, Monheit, Scott, and Suggs, with Mr. Furman serving as chair. During a portion of fiscal 2021, Mr. Gluchowski and Ms. Wadecki also served on the Nominations and Corporate Governance Committee, with Ms. Wadecki

| |

| |

serving as the chair, before joining the Board of Directors of AOUT. Mr. Suggs was appointed to the Nominations and Corporate Governance Committee following fiscal 2021 in connection with his appointment to our Board of Directors.

The Nominations and Corporate Governance Committee will consider persons recommended by stockholders for inclusion as nominees for election to our Board of Directors if the information required by our bylaws is submitted in writing in a timely manner addressed and delivered to our Secretary at the address of our executive offices set forth in this proxy statement. The Nominations and Corporate Governance Committee identifies and evaluates nominees for our Board of Directors, including nominees recommended by stockholders, based on numerous factors it considers appropriate, some of which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity, and the extent to which the nominee would fill a present need on our Board of Directors.

The Environmental, Social, and Governance Committee

The purpose of the Environmental, Social, and Governance, or ESG, Committee is to assist the Board of Directors and the various committees of the Board of Directors, as applicable, in fulfilling the oversight responsibilities of the Board of Directors with various environmental, social, health, safety, and governance policies and operational control matters relevant to our company, particularly those that do not come within the purview of other standing committees of the Board of Directors or the Board of Directors itself. Among other things, the ESG Committee plans to focus on environmental matters, including energy use, water use, sustainability, recycling, pollution, and hazardous waste; social, health, and safety matters, including workplace health and safety, working conditions, employee opportunities, employee training, diversity and inclusion, and corporate giving and philanthropy; and governance matters, including privacy and workplace ethics and compliance.

The ESG Committee currently consists of Ms. Britt and Messrs. Golden and Diaz, with Mr. Golden serving as the chair. In view of the wide range of matters considered by the ESG Committee, various high-level executives serve as ex-officio members, including our company’s Chief Financial Officer, Corporate Controller, Senior Manager of Internal Audit, Vice President of Operations, and Senior Director of Human Resources. The ESG Committee was established as an ad hoc committee during fiscal 2021 and formalized as a standing committee in early fiscal 2022 with the plan to meet at least quarterly on a go-forward basis.

Risk Assessment of Compensation Policies and Practices

We have assessed the compensation policies and practices with respect to our employees, including our executive officers, and have concluded that they do not create risks that are reasonably likely to have a material adverse effect on our company.

Board’s Role in Risk Oversight

RiskThe Board recognizes that risk is inherent in every business. As is the case in virtually all businesses, the Board recognizes that we face a number of risks, including operational, economic, financial, cybersecurity, legal, regulatory, and competitive risks. OurWhile our management is responsible for the day-to-day management of the risks we face. Ourface, the Board, of Directors, as a whole and through its committees, has responsibilityis responsible for the oversight of risk management.

In its oversight role, our Board of Directors’

The Board’s involvement in our business strategy and strategic plans plays a key role in its oversight of risk management, its assessment of management’s risk appetite, and its determination of the appropriate level of enterprise risk. OurThe Board of Directors receives updates at least quarterly from senior management and periodically from outside advisors regarding the various risks we face, including operational, economic, financial, cyber security,cybersecurity, legal, regulatory, and competitive risks. OurThe Board of Directors also reviews the various risks we identify in our SEC filings, with the SEC as well as risks relating to various specific developments, such as acquisitions, securities repurchases, debt and equity

| |

| |

placements, and new product introductions. In addition, ourthe Board of Directors regularly receives reports from senior members of our Senior Manager of Internal Audit function and our General Counsel and Chief Compliance Officer.

Our

See Part I, “Item 1A. Risk Factors,” in our annual report on Form 10-K for the fiscal year ended April 30, 2023 (the “Form 10-K”) to learn more about the risks we face. The risks described in the Form 10-K are not the only risks we face. Additional risks and uncertainties not currently known or that may currently be deemed to be immaterial based on the information known to us also may materially and adversely affect our business, operating results, and financial condition. | Governance Spotlight In fiscal 2023, we formalized a process whereby our Audit Committee Chair communicates directly with our Chief Compliance Officer at least quarterly in order to enhance the Board’s oversight of risk and the independence of our compliance function. | |

Given the nature of our business, the Board remains focused on overseeing risk management. During fiscal 2023, the ESG Committee discussed the campaign against the firearm industry at each of its meetings and the full Board reviewed an updated report prepared by a third-party media monitoring firm that we have worked with for several years. | ||

9 I 2023 Proxy Statement |

|

Board and Governance Matters | |

AUDIT COMMITTEE | COMPENSATION COMMITTEE | |||||

• Oversees our financial and reporting processes and the audit of our financial statements • Assists the Board with respect to: - the oversight and integrity of our financial statements - our compliance with legal and regulatory matters - our policies and practices related to information security, including cybersecurity - the independent registered public accountant’s qualification and independence - the performance of the independent registered public accountant • Meets separately on a regular basis with representatives of our independent registered public accountant and our internal audit function | • Considers the risk that our compensation policies and practices may have in attracting, retaining, and motivating valued employees • Endeavors to ensure that it is not reasonably likely that our compensation plans and policies would have a material adverse effect on us NCG COMMITTEE • Oversees governance-related risk, such as board independence, conflicts of interest, and management and succession planning ESG COMMITTEE • Reviews emerging risks associated with ESG matters |

Cybersecurity Risk Oversight. We recognize the importance of cybersecurity risk governance. The Audit Committee receives regular reports from management on, among other things, the emerging cybersecurity threat landscape and our cybersecurity risks and threats. The Audit Committee regularly briefs the full Board on these matters. We maintain a Cyber Incident Response Plan.